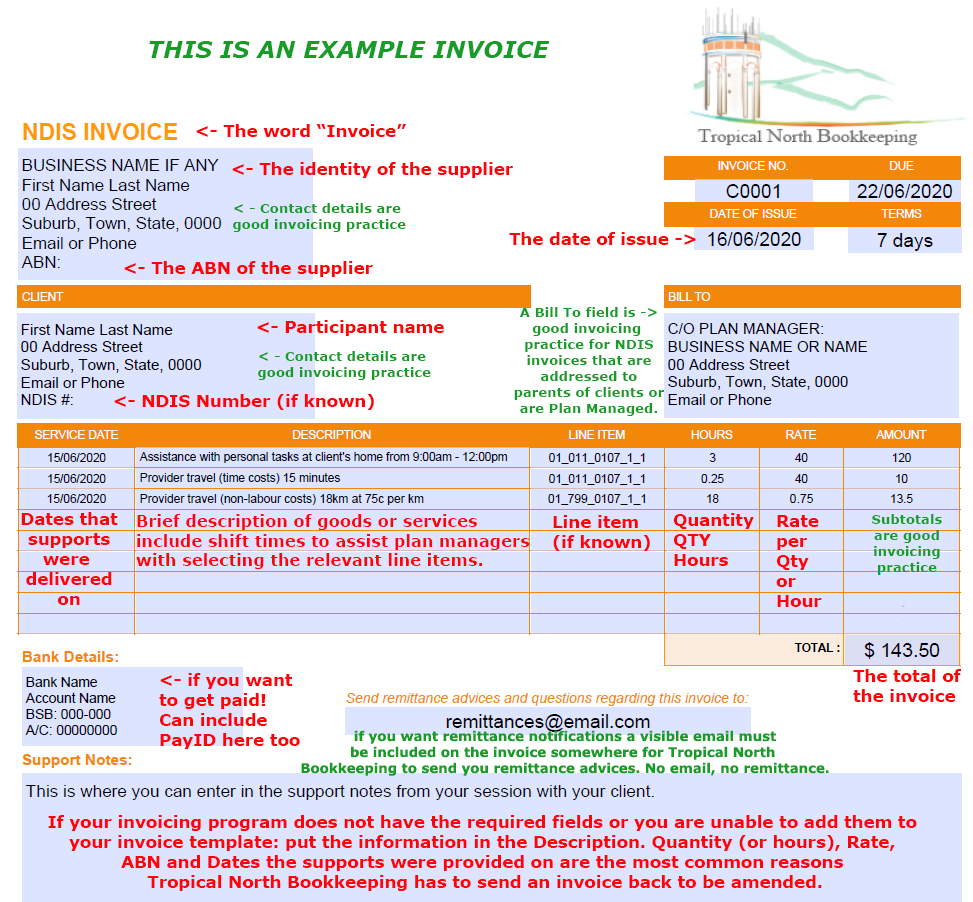

<- Example Invoice

Click on the image to see an example invoice that shows what information an invoice should have. For a larger image, scroll to the bottom of this page. Please note that the red writing indicates the absolute BARE MINIMUM for invoices to be ATO and NDIS compliant. Click here for our Factsheet - Is The Invoice Compliant? for more information. Need more help with invoicing?

For Providers

NDIS Providers: What you need to know

All providers, regardless of if they are registered or unregistered, must follow the NDIS Code of Conduct. This includes having appropriate professional liability insurance in place, as well as keeping appropriate records.

The Role of a Plan Manager

Plan management is a disability service funded by the NDIS to assist participants to manage their funding. A plan manager can do the following things for participants:

• manage and monitor a participant’s budget

• manage a participant’s NDIS claims and disburse funds to providers for services delivered

• provide regular statements to a participant to show the financial status of their plan including

prompt notification of over or under utilisation

• alert the participant of any risks associated with paying for supports not funded by NDIS, or over/under spending.

• ensure compliance with price limits and rules in the NDIS Price Guide.

Provider Responsibility

Like with any other business, it is the provider's responsibility to ensure appropriate invoicing and recordkeeping practices are occurring. The Australian Taxation Office (ATO) has information on minimum invoice requirements as well as GST-free NDIS supplies.

Establishing a service agreement with the participant you provide services for is encouraged and recommended by Tropical North Bookkeeping. This clarifies provider and participant responsibility, expected hours, rate per hour, services provided and any other agreements which can be referred back to at any time. Service agreements also assist providers with getting paid faster.

However, if you are charging additional fees for provider travel, non-face-to-face costs, cancellations etc, it is compulsory to have this agreement in writing in advance of providing services. The NDIA have advised Tropical North Bookkeeping that this agreement must be written by way of a service agreement. As such we will only pay the service portion of the invoice if there is no service agreement and these fees are being charged without the participant's written agreement. We will let you know if this happens and you will have the option of amending your invoice or following up with the participant.

Getting Help as a Provider

Tropical North Bookkeeping gets a large volume of queries for assistance from providers and responding to each takes time away from participants and the plan management role. The NDIS pays plan managers to provide assistance to participants and this time is expected to be invested in helping participants to manage their NDIS plan. It is not for providing free bookkeeping support for providers.

Tropical North Bookkeeping does not write Service Agreements. You can seek the help of a support coordinator or legal practitioner who does this type of work.

Why Does Tropical North Bookkeeping recommend Service Agreements?

Having a Service Agreement with the participant that details the services provided, the expected hours, rate per hour, how travel is to be handled, and so on will make it quicker and simpler for Plan Managers to verify invoices.

With a service agreement in place, all parties can refer to the agreement to understand their responsibilities and obligations. This is a protective factor that safeguards participants and ensures provider accountability. Likewise, such agreements also assist participants to understand what is required of them for the provider to continue to provide supports.

Getting Paid: What you need to know

A healthy cash flow is critical to any business. Tropical North Bookkeeping is invested in quick processing and payment of invoices as this helps to support a healthy working arrangement between participant and provider.

Payment time frames depend on your invoice being compliant with ATO and NDIS requirements, degree of the participant's involvement in the authorisation process, approval of the claim for funds by NDIA and your chosen payment method. As a general rule, Tropical North Bookkeeping strives to claim for funds on compliant invoices within 2-3 business days, and this is paid for immediately once the funds arrive.

Please note: Plan managers must follow pricing controls established by the NDIA in the NDIS Price Guide, and cannot pay invoices with supports that exceed the relevant price control. Click here for our Factsheet - Is The Invoice Compliant? for a downloadable print-out.

Invoice Requirements

|

|

What Support Line Item do I use?

This is a common question asked by providers. To be able to provide feedback on how to invoice correctly under the NDIS, more information is needed. For example, the shift start and finish times of a support worker, the dates of these shifts, whether there was travel, what that looks like, what services are being provided during the shift, the qualifications of the worker(s), what the participant has agreed to pay, whether the worker is employed by the participant or is an independent contractor. Working this out can be time extensive unfortunately, and falls under appropriate invoicing practices and the responsibility of the provider.

If you do not know the support line item, and there is no service agreement in place, please ensure you list an accurate description of services provided so Tropical North Bookkeeping can attempt to match it to the best support line item by conferring with the participant if more information is needed. Note this can delay the processing time of invoices.

The NDIS Price Guide and the Support Catalog can be found here to assist you with locating the service you are providing. Questions about these documents can be directed to the Provider Line on 1800 800 110.

How Much Can I Charge?

The short answer to this is - it is entirely up to the participant what they are willing to pay! Some participants will pay the difference, but most participants will not, and will find another provider. As a plan manager, Tropical North Bookkeeping can only pay up to the maximum price control for the relevant support item on the invoice.

To ensure your services fall within these price limits, please refer to the NDIS Price Guide and the Support Catalog. Questions about these documents can be directed to the Provider Line on 1800 800 110.

Charging for Non-Direct Services

To charge additional fees for non-direct services like Non-face-to-face supports, Provider Travel, Short Notice Cancellations and NDIA Requested Reports, there are requirements which must be met for plan managed and NDIA managed participants.

The NDIA have informed Tropical North Bookkeeping that providers MUST detail these additional fees in writing by way of a service agreement, and in ADVANCE of services being provided.

If you are charging these fees, you will have to lodge a current, fully signed and dated service agreement with Tropical North Bookkeeping for us to process your invoices. There are no exceptions.

If Tropical North Bookkeeping does not have a service agreement, we will only pay the service portion of the invoice. Invoice payment will be delayed as we will have to verify the invoice and confirm with the participant how they wish to proceed. We will let you know if this happens and you will have the option of amending your invoice or following up with the participant.

Can I See An Example Invoice?